Monday, March 9

Chevron’s warning to Gavin Newsom and the California Air Resources Board (CARB) must be taken seriously. Read More

It was not that long ago that Sam Altman’s OpenAI appeared to be enjoying a comfortable lead in the corporate race to bring artificial... Read More

Programmers may be replaced by their machines, but we'll still need people to build the data centres and produce the energy to run them Read More

The most important lessons of an economic way of thinking haven't changed much in 40 years. But the students have. Read More

He issued two key moral prescriptions that changed Western civilization. Read More

Alexander Kustov’s new book argues that people are more likely to support policies that demonstrably benefit them and their fellow... Read More

Recently, a letter signed by former House Speaker Newt Gingrich, Americans for Tax Reform President Grover... Read More

The more the president insists the economy is amazing, the more we’re confronted with evidence to the contrary. Read More

A politician who has built nothing wants to tear down what others have achieved. Read More

The push to shrink the Federal Reserve’s balance sheet assumes that reducing reserves tightens monetary policy. In today’s operating... Read More

There’s production and nothing else, with government spending, government borrowing, money in circulation, and interest rate levels an... Read More

Cryptocurrencies were designed to be a hedge against the U.S. dollar, which crypto creators viewed as an unreliable currency. Yet one of the... Read More

Insiders close to the Wall Street giant say the real culprit can be summed up in two letters: “A” and “I.” Read More

The semi-annual time change that happens every spring and fall provides safety reminders for smoke detector batteries and creates a national... Read More

Five years ago in another publication I asked a simple, uncomfortable question about the Project Artemis moon program: Why? At... Read More

America's coal output has been falling for decades, and a turnaround isn't in the cards. Read More

Experts have mixed opinions on the phenomenon’s staying power Read More

America stands at an inflection point for infrastructure investment. The systems that move goods, power homes, and connect... Read More

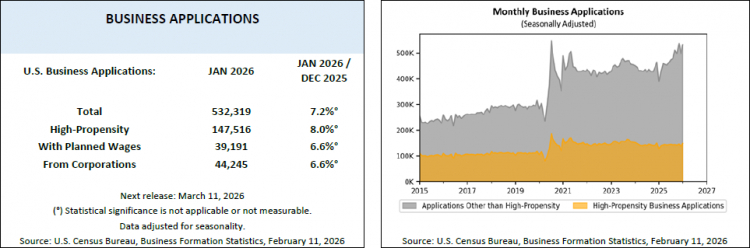

The Trump administration has given the U.S. economy a powerful boost through an ambitious and disciplined deregulatory agenda. According to a... Read More

Most discussions of financial stability focus on prices, valuations, and economic indicators. Yet far less attention is paid to a more basic... Read More

The February payroll report was an ugly one, and a bit of a mess. Read More

We could use a little more panic right now. Read More

Railroad stocks still outperformed despite the bubble Read More

Some thoughts on what's going on in private markets. Read More

A growing number of prominent Trump allies - including former House speaker Newt Gingrich, veteran strategist Kellyanne Conway and GOP... Read More

Luxury timepieces are one of the most effective mediums to move illicit funds around the globe and a tool to integrate those ill-gotten gains... Read More

They work together to contain it before it spreads. Read More

The surge in new US business formation is being fueled by AI and large language models that are dramatically reducing... Read More

AI technology is transformative and here to stay. But the inflated financial architecture supporting it may be unsustainable. Read More

Long-term care needs are one of the most common and financially significant risks in retirement. Read More

When war breaks out, micro issues have a way of quickly becoming macro issues. Specific blockages and bottlenecks tend to cause broad supply... Read More

As with the recent escalation in the Middle East, financial markets are constantly exposed to unpredictable events — from geopolitical... Read More

More From Real Clear

RealClearMarkets Saturday

Long-term care needs are one of the most common and financially significant risks in retirement. ... Read More

- Donna LeValley, Kiplinger

- Karl Polzer, The Hill

- Jessica Grose, The New York Times

- Katie Brockman, Motley Fool

Most discussions of financial stability focus on prices, valuations, and economic indicators. Yet far less attention is paid to a more basic question: what do investors legally own when they buy stocks and funds through a brokerage account? The answer is not what most investors assume. Over the past several decades, deliberate changes to securities law and market infrastructure quietly redefined o... Read More

- David Whiteley, RealClearMarkets

- Sam Ro, TKer by Sam Ro

- Eric Miller, RealClearMarkets

- Brian O'Connell, U.S. News & World Report

Today's Topics

- In the News

- Follow RealClearMarkets on Social

- Corporate Governance

- Global Political Economy

- Corporate News

- RealClearMarkets Originals

- Videos & Podcasts

-

Most Read

- Last 24 Hours

-

Why is Private Equity Crashing?

- Ben Carlson, A Wealth of Common Sense

-

Why So-Called "YIMBY" Movement Could Be On Way Out

- Justin Klawans, The Week

-

America Can't Withstand Econ. Shock That’s Coming

- Gina Raimondo, New York Times

-

I'm the Only Man In America Who Wants to Keep Daylight Saving

- Bill Korman, Fox

- Last 7 Days

-

America Can't Withstand Econ. Shock That’s Coming

- Gina Raimondo, New York Times

-

The Bond Market Is Trying to Tell You Something

- Ed D'Agostino, Mauldin Economics

-

U.S. Treasuries Failing Their Biggest Test In Decades

- Mark Hulbert, Marketwatch